The CRE "AI Scare Trade"

What the Data Actually Shows

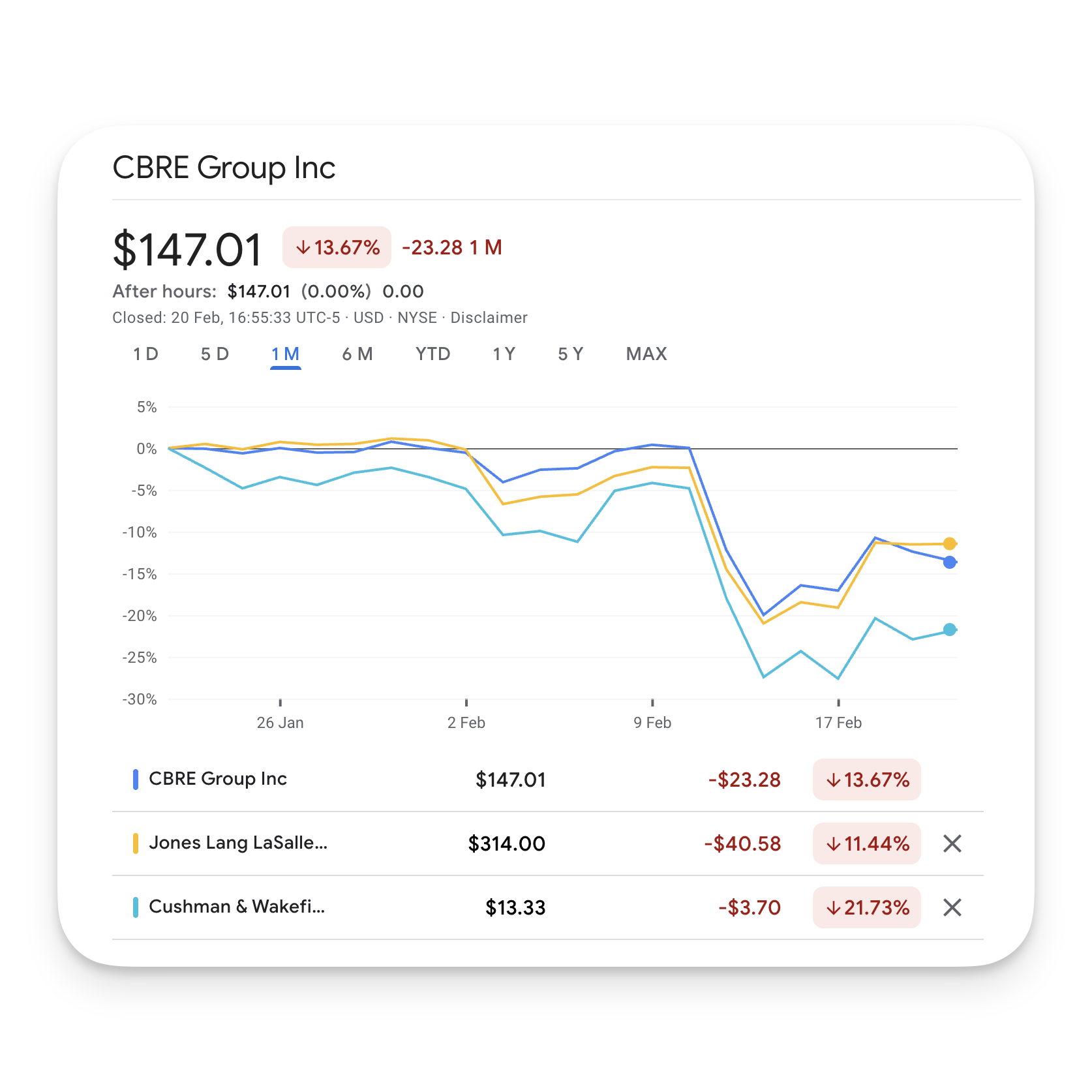

When CBRE beat earnings and dropped 20% anyway

The February Selloff: Earnings Beat, Stock Collapse

On February 12, CBRE reported its Q4 results. Revenue up 12%, earnings beat expectations, guidance raised for 2026. One of the strongest quarters on record.

The stock dropped 20% in two days anyway. JLL fell 19%. Cushman dropped 24%. About $14 billion in combined market cap, gone. The sharpest declines any of them had seen since 2020.

The Narrative: "AI Scare Trade"

The Guardian, CNN, and Yahoo Finance all called it the same thing: the "AI scare trade" — markets selling off professional service firms they believe AI will eventually replace. Brokerage, research, leasing, valuation. The core of what CRE firms sell.

There was no single news event that triggered it. SupplyChainBrain noted the catalyst was unclear. This was investors repricing the whole sector at once, on the same day CBRE posted record results.

That's the part worth sitting with. A 20% drop on a good earnings day isn't a reaction to last quarter. It's a bet on what the business looks like in five years.

What the Data Actually Shows

Here's where it gets interesting.

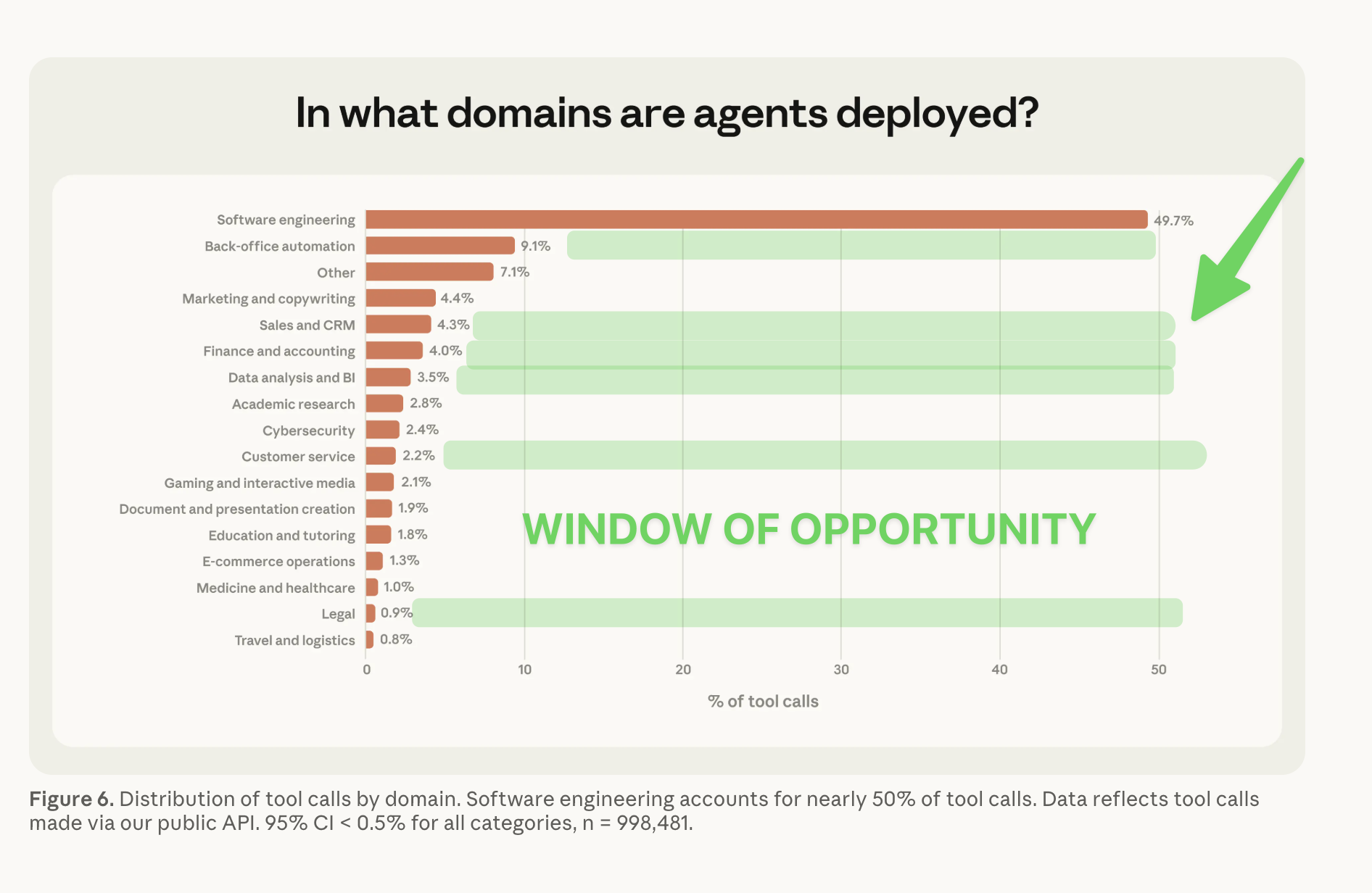

Anthropic — one of the leading AI research labs, direct competitor to OpenAI — published a study this month tracking 998,481 real-world enterprise AI usage events. The picture looks nothing like what the market is pricing.

| Function | % of Enterprise AI Usage |

|---|---|

| Software Engineering | ~50% |

| Back-office Automation | 9.1% |

| Sales & CRM | 4.3% |

| Data Analysis & BI | 3.5% |

| Legal | 0.9% |

Nearly half of all enterprise AI is concentrated in software engineering. That's where the crowd went.

Every category under 10% is a function still running on manual effort and institutional memory. That's where the stress is. Where the budget pressure is. Where someone pulls the same comps, reviews the same lease clauses, builds the same market summary — on every single deal.

For CRE occupier services, that's most of the work between origination and close. And it's sitting at less than 4%.

The Gap: What This Means

The disruption the market is pricing hasn't reached the operational layer yet.

2026 is when this locks in — not because of a regulation or a product launch, but because the firms that move now will have embedded AI into their core workflows before the rest of the industry catches up. The conditions are unusually favorable right now:

The technology is cheap, subsidized by billions in VC capital. Clients are paying attention and open to new tools. The incumbents are slow.

This is the window. It won't stay open.

The February 12 move shows investors are already watching who moves and who waits. The market isn't pricing last quarter. It's pricing the next five years.

Key Takeaways

- The selloff was about fear, not fundamentals. CBRE beat earnings and raised guidance the same day the stock dropped 20%. No single event caused it — just broad sentiment betting on long-term AI displacement.

- Media consensus was unanimous. The Guardian, CNN, Yahoo Finance, MarketWatch, and Bisnow all read it the same way: markets pricing structural disruption of human-driven CRE services.

- Actual adoption lags the fear. Anthropic's data covers 998,481 real API calls. Operational AI in professional services is still in low single digits.

- The window is real and measurable. Firms moving now have 12 to 18 months before this becomes standard. That gap is the advantage.

Sources

CBRE Q4 2025 Earnings Release:

ir.cbre.com/press-releases/detail/261/cbre-group-inc-reports-financial-results-for-q4-and-full

Zacks: CBRE Group Q4 Earnings Beat Estimates

zacks.com/stock/news/2863212/cbre-group-q4-earnings-beat-estimates-revenues-rise-yy

The Guardian: Share values of property services firms tumble over fears of AI disruption

theguardian.com/technology/2026/feb/12/share-values-of-property-services-firms-tumble-over-fears-of-ai-disruption

CNN Business: Why the 'AI scare trade' might not be done

cnn.com/2026/02/16/business/ai-disruption-fears-us-stocks

Yahoo Finance: Real Estate Stocks Sink as Worries About AI Risks Spread

finance.yahoo.com/news/real-estate-stocks-sink-worry-193805129.html

MarketWatch: The stock market is reflecting fears of an AI apocalypse for white-collar jobs

marketwatch.com/story/the-stock-market-is-reflecting-fears-of-an-ai-apocalypse-for-white-collar-jobs-c845c508

Bisnow: 5 Major Brokerages' Stocks Plummet Amid Fears Of AI Impacts

bisnow.com/national/news/commercial-real-estate/jll-cbre-cushman-wakefield-cre-ai-scare-133185

SupplyChainBrain: Former Karaoke Company Drags Logistics Into the AI Scare Trade

supplychainbrain.com/articles/43474-former-karaoke-company-drags-logistics-into-the-ai-scare-trade

Anthropic Research: Measuring Agent Autonomy (February 2026)

anthropic.com/research/measuring-agent-autonomy